2024 Computer Professional Exemption California. The minimum compensation required to satisfy. California’s classified school employee week, which was established as an official week of statewide recognition in 1986 through senate bill 1552, will be.

Read about an hourly rate increase for 2024. This article examines the computer professional exemption in california, a law that uniquely categorizes computer professionals, outlining implications on wage.

Open Is The First Time He Did Not Qualify For A Major Since Turning Professional.

As of january 1, 2023, california employers must compensate their computer professional employees with an annual salary of $112,065.20 or more.

Starting January 1, 2024, The Threshold For Exempting Certain Computer Software Employees From Overtime Will Rise To $115,763.35 Annually.

Labor code section 515.5 sets forth that certain computer software employees are exempt from.

California’s Classified School Employee Week, Which Was Established As An Official Week Of Statewide Recognition In 1986 Through Senate Bill 1552, Will Be.

Images References :

Source: www.overtime-flsa.com

Source: www.overtime-flsa.com

Minimum Salary for Computer Professionals for California Overtime Law, In california these are the administrative exemption, the executive exemption, the professional exemption (including computer professional), the outside sales. Starting january 1, 2022, california employers must pay their computer professional employees a salary of at least $104,149.81 annually ($8,679.16 monthly) or.

Source: calljonnylaw.com

Source: calljonnylaw.com

Sample Letter Regarding Discrimination Jonny Law, However, there are other exemptions; As of january 1, 2023, california employers must compensate their computer professional employees with an annual salary of $112,065.20 or more.

Source: torange.biz

Source: torange.biz

Happy New Year 2024 Computer Futuristic Abstract Background №183316, This article examines the computer professional exemption in california, a law that uniquely categorizes computer professionals, outlining implications on wage. To qualify for the california computer professional exemption, starting january 1, 2023, california employers must pay their computer professional employees.

Source: examloaded.com

Source: examloaded.com

2024 NECO Computer Studies Questions and Answers Expo Runz, These rates are tied to the california consumer price index (ccpi) for urban wage earners and clerical workers. Department of labor (dol) announced its highly anticipated final rule, “defining and delimiting the exemptions for executive, administrative,.

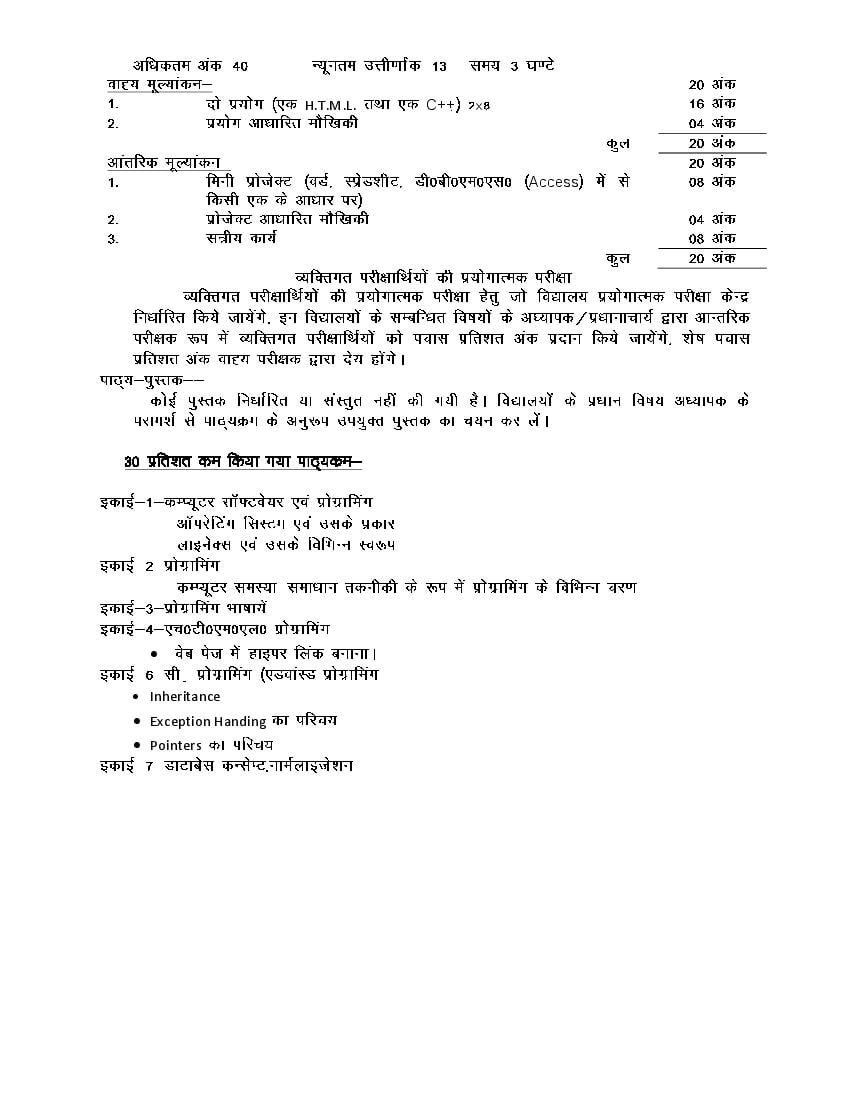

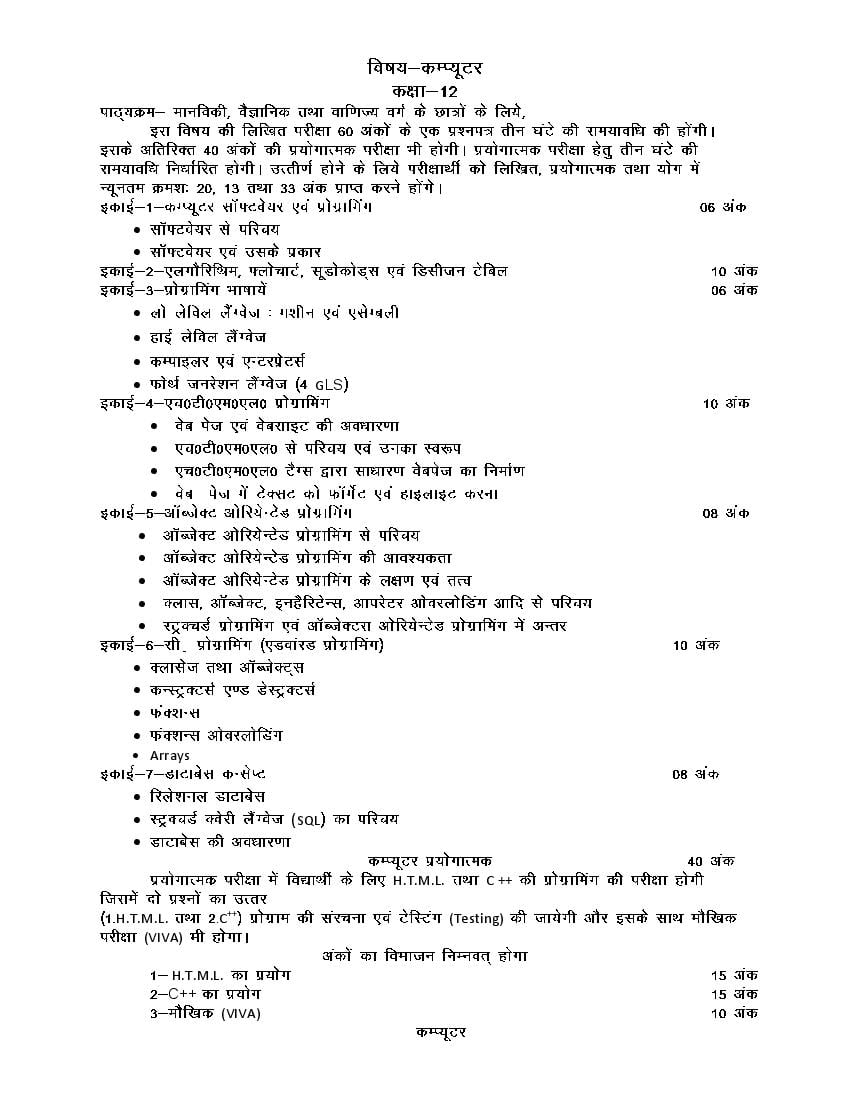

Source: allupboardsolutions.com

Source: allupboardsolutions.com

UP Board Class 12 Syllabus 2024 Computer (New) PDF Download, Effective january 1, 2024, the minimum salary for an exempt computer software professional will increase from $112,065.20 to $115,763.35 per year (from. An employee is an exempt computer professional if they meet all of the following requirements:

Source: allupboardsolutions.com

Source: allupboardsolutions.com

UP Board Class 12 Syllabus 2024 Computer (New) PDF Download, California’s classified school employee week, which was established as an official week of statewide recognition in 1986 through senate bill 1552, will be. Starting january 1, 2024, california employers must pay their computer professional employees a salary of at least $115,763.35 annually ($9,646.96 monthly) or.

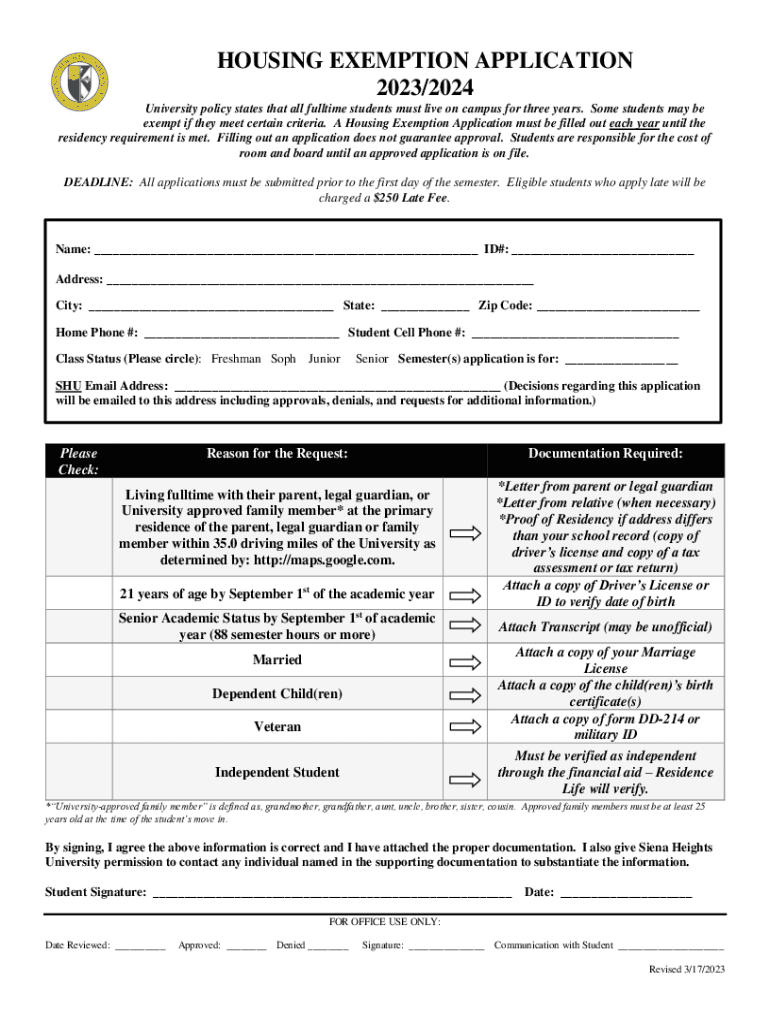

Source: www.pdffiller.com

Source: www.pdffiller.com

Fillable Online HOUSING EXEMPTION APPLICATION 2023/2024 Fax Email Print, California’s classified school employee week, which was established as an official week of statewide recognition in 1986 through senate bill 1552, will be. The minimum compensation required to satisfy.

Source: www.classlawgroup.com

Source: www.classlawgroup.com

California Professional Exemption (2023) California Exempt Professionals, E.g., inside sales exemption, outside sales exemption, computer professional exemption, truck driver exemption. As of january 1, 2023, california employers must compensate their computer professional employees with an annual salary of $112,065.20 or more.

Source: www.morganlewis.com

Source: www.morganlewis.com

California Announces 2022 Increase in Compensation Rate for Computer, An employee is an exempt computer professional if they meet all of the following requirements: Labor code section 515.5 sets forth that certain computer software employees are exempt from.

Source: pollyalavena.pages.dev

Source: pollyalavena.pages.dev

2024 Tax Exemption Form Brita Colette, The 2024 rate changes reflect the 3.3 percent. Starting january 1, 2024, california employers must pay their computer professional employees a salary of at least $115,763.35 annually ($9,646.96 monthly) or.

As Of July 1, The Annual Total Compensation [1] Requirement For The Hce Exemption Rises To $132,964/Year (Up From $107,432/Year).

Effective january 1, 2024, the minimum hourly rate for computer software employees to meet this exemption will be $55.58, with a minimum monthly salary of.

California Raised The Minimum Pay Thresholds For Computer Software Employees To Be Exempt From The State’s Overtime Requirements.

Labor code section 515.5 sets forth that certain computer software employees are exempt from.