Ira And Roth Ira Limits 2024

The annual contribution limit for a traditional ira in 2023 was $6,500 or your taxable. Not fdic insured • no bank guarantee • may lose value the charles schwab corporation provides a full range of brokerage, banking and financial advisory services through its operating subsidiaries.

Investing in a roth ira means your money grows free from the irs’s grasp, ensuring more funds for your golden years. The amount you can contribute to a traditional ira:

Get Details On Roth Ira Income Limits.

The roth ira contribution limit for 2024 is $7,000 for those under 50, and an additional $1,000 catch up contribution for those 50 and older.

The Ira Contribution Limits For 2024 Are $7,000 For Those Under Age 50, And $8,000 For Those Age 50 Or Older.

Assuming that your earned income is at least this much, there is.

Images References :

Source: verilewbeulah.pages.dev

Source: verilewbeulah.pages.dev

Roth Ira Limits 2024 Irs Sukey Stacey, Roth ira contribution limits for 2024. The maximum amount you can contribute to a roth ira for 2024 is $7,000 (up from $6,500 in 2023) if you're younger than age 50.

Source: coralynwelsa.pages.dev

Source: coralynwelsa.pages.dev

Roth Ira Limits 2024 Limits Calculator Deena Kathryn, The roth ira income limit to make a full contribution in 2024 is less than $146,000 for single filers, and less than $230,000 for those filing jointly. Can't exceed the amount of income you earned that year.

Source: www.advantaira.com

Source: www.advantaira.com

2024 Contribution Limits Announced by the IRS, The roth ira income limits will increase in 2024. The most obvious consequence of exceeding the roth ira limit is that you are no longer eligible to make direct contributions to a roth ira for the tax year in question.

Source: www.aarp.org

Source: www.aarp.org

Everything You Need To Know About Roth IRAs, For the 2024 tax year: The roth ira contribution limit for 2024 is $7,000 for those under 50 and up to $8,000 for those 50 or older.

Source: vallyqroshelle.pages.dev

Source: vallyqroshelle.pages.dev

Irs Contribution Limits 2024 Bev Carolyne, And it’s also worth noting that this is a cumulative limit. Whether or not you can make the maximum roth ira contribution (for 2024 $7,000 annually, or $8,000 if you're age 50 or older) depends on your tax filing status and your modified adjusted gross income (magi).

Source: www.financestrategists.com

Source: www.financestrategists.com

IRA Contribution Limits 2024 Finance Strategists, Featured partner interactive brokers roth ira view offer; You can leave amounts in your roth ira as long as you live.

Source: lauriewgreta.pages.dev

Source: lauriewgreta.pages.dev

Ira Limit For 2024, Ira contribution limits for 2024. Not fdic insured • no bank guarantee • may lose value the charles schwab corporation provides a full range of brokerage, banking and financial advisory services through its operating subsidiaries.

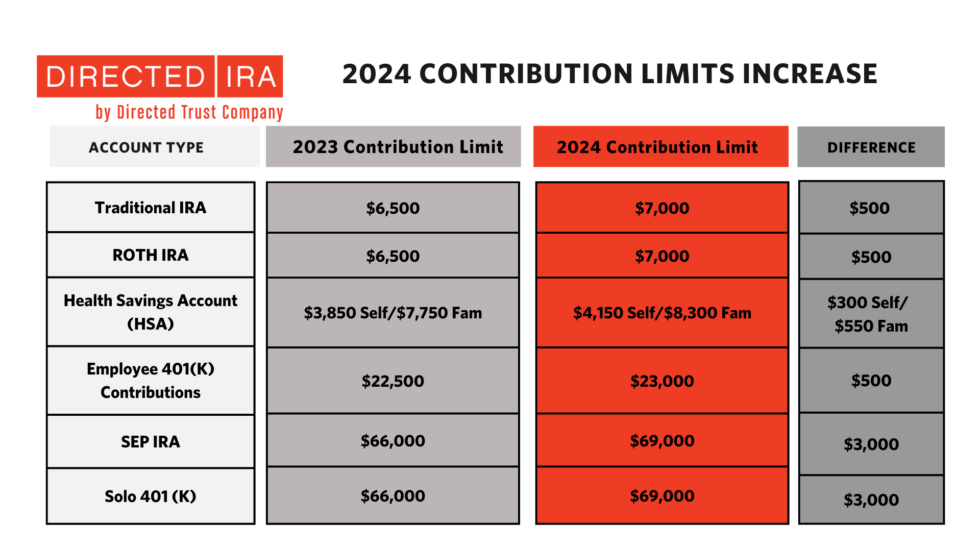

Source: directedira.com

Source: directedira.com

Contribution Limits Increase for Tax Year 2024 For Traditional IRAs, Td ameritrade roth ira learn more To do this, you'll need to.

Source: www.mybikescan.com

Source: www.mybikescan.com

"Your Guide to Roth IRA Contribution Limits 2024 in the USA" MyBikeScan, In 2024, these limits are $7,000, or $8,000 if you're 50 or older. The ira contribution limits for 2024 are $7,000 for those under age 50, and $8,000 for those age 50 or older.

Source: us.firenews.video

Source: us.firenews.video

Roth IRA Contribution Limit 2024 2024 Roth IRA Contribution Limits in, In 2024, the roth ira contribution limit is $7,000, or $8,000 if. The annual contribution limit for a traditional ira in 2023 was $6,500 or your taxable.

A Wide Range Of Assets:

Can't exceed the amount of income you earned that year.

Being Able To Open A Roth Ira Depends On Your Income, But There Are No Income Limits For Having A 401 (K), Although The Irs Specifies How Much Of An Employee's Income Can Be Considered For.

You can make contributions to your roth ira after you reach age 70 ½.

Posted in 2024